Mullins' Seven Domains Model

Analyzing Business Opportunities

© iStockphoto

stanley45

Road test your business with Mullin's Seven Domains.

Can you imagine buying a car without first taking it for a test drive? Or buying a home without first inspecting every room?

In everyday life, it's instinctive to test products and to look at them from different angles before parting with your money. This helps you confirm that you're making the right choice.

The same should be true before you start a business, or launch a new project or product. You need to look at it thoroughly, and examine it from a number of different perspectives. After all, you could be about to invest several years of your life into the venture, and it would be heart-breaking if it failed for reasons that you could have foreseen at the outset.

Mullins' Seven Domains Model helps you explore the impact of seven key factors – or "domains" – on your planned venture. In turn, this helps you think about whether the idea is viable. We'll look at the seven domains in this article, and suggest questions and tools that you can use to explore your business idea.

About the Tool

John Mullins, an entrepreneur and professor at London Business School, developed the Seven Domains Model and published it in his 2003 book, "The New Business Road Test."

It was created for entrepreneurs interested in starting new businesses. However, you can also use it within your organization to decide whether to pursue a new product, or launch a new project.

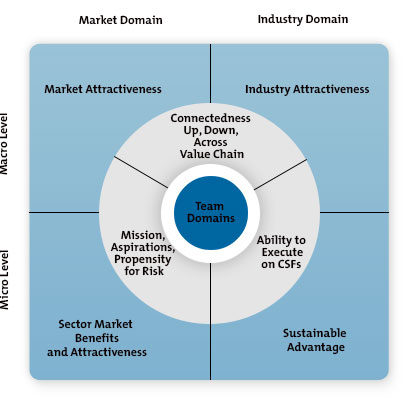

The model, shown in figure 1, is designed to be used before writing a business plan.

Figure 1 – Mullins' Seven Domains

Diagram reproduced from "The New Business Road Test: What Entrepreneurs Should Do Before Writing a Business Plan" by J. Mullins, published by Pearson Education.

The model separates your proposed new venture into seven "domains": four that look at the small-scale (micro) and large-scale (macro) aspects of your market and industry, and three that focus on your team.

When you look at each of these domains and ask key questions about each, you'll have a clearer idea about how likely your business idea is to succeed.

You'll also identify possible challenges that you'll need to address when you write your business plan. This is especially important if you need outside funding for your business.

Note:

The terms "market" and "industry" are sometimes used interchangeably, but they have very different meanings.

Your market is the group of people who are, or will be, buying your product or service.

Your industry is the group of sellers, most often organizations, that offer products or services similar to your own. These are your competitors.

Looking at the Seven Domains

Let's look at the seven domains, and explore how you can use them to analyze your potential venture.

Market Domain/Macro Level: Market Attractiveness

This domain looks at market attractiveness from a macro (large-scale) perspective.

Look at the whole market. How big is it, in terms of the number of customers, the value of sales, and the quantity of units sold? Then, look at trends within the market. Has it grown in recent years? If so, is this growth likely to continue?

What you're doing here is checking that the market is big enough to give you the growth you want, and that it's growing healthily – after all, it's much easier to grow a business in a growing market than it is in a declining one.

Also, use PEST analysis to explore the large-scale factors that affect your market. Do these look healthy?

Market Domain/Micro Level: Sector Market Benefits and Attractiveness

Realistically, it's unlikely that your venture will meet the needs of everyone in the market. You'll be more successful if you target your idea at one market sector or segment, and aim to meet its needs fully.

To identify this segment, look at the market on a micro level. Think about the following questions:

- Which segment of the overall market is most likely to benefit from your venture?

- How is your venture or product different from others already servicing this segment?

- What trends is this segment showing? Is it growing, and, if so, is this growth set to continue?

- What other market segments could you access if you're successful in this one?

Look for qualitative and quantitative data. Talk to prospective customers to gather feedback on their needs, and to find out how well competitors are meeting these. Then, look for data on the sector you're targeting, for example, by reading analysts' reports and market research reports.

Industry Domain/Macro Level: Industry Attractiveness

It's now time to look at how attractive your industry is on a macro level.

Mullins suggests using Porter's Five Forces to assess which factors affect the profitability of your industry.

To do this, first define the industry that you will be competing in, and then ask yourself how easy it is to enter this industry. If it's easy to get into, you can quickly be flooded with competitors if you are seen to make a success of your business.

Next, look at your competition. Is rivalry in this market fierce or civilized? Are organizations stealing ideas from others in the industry? Take time to gather intelligence about your potential competitors to see what they're up to.

Last, look at buyers and suppliers. How much power do they have? Are they setting their own terms and conditions because of this power? If so, how will this affect your offering?

Industry Domain/Micro Level: Sustainable Advantage

Once you've looked at your industry from a macro level, it's time to examine it close up.

Start with a USP Analysis. What can you do to build and sustain a USP? Next, explore the competencies that you'll need, and think about how to develop and sustain these.

Then think about how easy it will be for your competitors to duplicate your product or service.

Also, what resources do you possess that your competitors don't? Do a VRIO Analysis to answer this question, and then look at your competitors' resources. What do they have that you don't? This could include patents, established processes, and finances. How will these affect your ability to compete?

Team Domain: Mission, Aspirations, Propensity for Risk

In this domain, located in the center of the model, you're going to analyze commitment – yours, and that of your team – to this idea.

Think about why you want to start this business. Are you passionate about this idea, and, if so, why? What do you want to do with this business – are you ambitious for it, or do you want it to be a "lifestyle business"? What are your personal goals and values, and how does this venture align with these? And are you prepared to take the risk and put in the hard work needed to build this business?

Explore the motivations of your team, too. What are they hoping to achieve, and why? Do their motivations align with yours? And are they prepared to work really hard to make the business a success?

Money and/or reputations could be at stake if the venture fails, so think about attitudes towards risk within the team. Our article "Cautious or Courageous?" can help you think about your approach to risk.

Team Domain: Ability to Execute on Critical Success Factors

You now need to identify the Critical Success Factors (CSFs) for the business, and think realistically about whether your team can deliver on these.

Start doing this by thinking about these questions:

- Which decisions or activities will harm the business significantly if you get them wrong, even when everything else is going right?

- Which decisions or activities will deliver disproportionately high benefits or enhance performance, even if other things are going poorly?

Then look at the knowledge and skills of the team that you've put together. How certain are you that you and your team can deliver successfully on these CSFs? If you see a gap in skills or abilities, who can you bring on board to fill this gap?

Team Domain: Connectedness up, Down, Across Value Chain

This last domain is all about your connections and how important they are to the success of your business.

First, look at your suppliers and investors. Who do you know that can supply you with the resources you need to pursue this venture? How good are your relationships with these people?

Next, look at your potential customers and distributors. In what ways can you capitalize on your connections here?

Last, look across the value chain. Do you know any of your competitors personally? If so, how could this relationship help or hinder your venture? And could these people be partners if you thought about them differently?

Next Steps

As you work through the model, it's likely that you'll come up against problems or challenges that you hadn't foreseen. You need to assess how critical these issues will be.

If they're related to your industry or your market, to what extent can you influence them? If they relate to you or your team, what can you change? What will the effect of these changes be?

At this point, you can make a "go/no-go" decision. If you decide to "go," carry on to develop your business plan. The good news is that, by properly exploring the seven domains, you will already have done a lot of the research that your business plan needs.

Key Points

John Mullins developed the Seven Domains Model and published it in his 2003 book "The New Business Road Test."

The model helps you explore a business idea from a variety of angles, including factoring in the knowledge and attitudes of your team. This helps you test the viability of your venture before you write a business plan or pursue funding.

It also allows you to refine your approach – or even abandon an idea altogether before you commit a lot of time and effort to it.

The model contains seven domains to consider:

- Target Segment Benefits and Attractiveness (Market Domain/Micro Level).

- Market Attractiveness (Market Domain/Macro Level).

- Industry Attractiveness (Industry Domain/Macro Level).

- Sustainable Advantage (Industry Domain/Micro Level).

- Mission, Aspirations, Propensity for Risk (Team Domain).

- Ability to Execute on CSFs (Team Domain).

- Connectedness Up, Down, Across Value Chain (Team Domain).

The model was originally created for entrepreneurs, but you can use this model in existing organizations to decide whether to pursue a new product idea or market expansion.

This site teaches you the skills you need for a happy and successful career; and this is just one of many tools and resources that you'll find here at Mind Tools. Subscribe to our free newsletter, or join the Mind Tools Club and really supercharge your career!

Great example!

James

I really like how the model connects at analysis of the competitive environment with an internal analysis of the companies ability to execute.

I have seen many good business ideas fail because of a failure to analyze team capabilities. One example really stands out for me when I was working in marketing.

Prior to a merger, a telecommunications company designed an innovative application, way ahead of its time. When the telecom companies merged, I was leading channel strategy. Upon examining the retail operations, and in particular, the processes to deliver the solution to the customer, it became abundantly clear that there were no processes in place! If a customer had an issue, the dealer would contact the telecom company. The company, in turn, gave away concessions. The commonly used phrase was the product was being managed by hamsters on wheels, scurrying to find the next fix.

In this example, the company was renowned for innovation, but terrible at operations management. Eventually, the product was taken off the market because it wasn't profitable -- the company was literally giving away profit to keep the product in the marketplace. Had they analysed the capabilities of their team, they would have shored up their operations practices and instilled more process discipline.

Zuni